colorado electric vehicle tax credit form

EVs in Colorado as of January 1 2022. Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase lease or conversion of a qualifying motor vehicle including an electric vehicle like a Tesla.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

You may use the Departments free e-file service Revenue Online to file your state income tax.

. This bill was successfully passed and signed on 62521 with support from representatives Edie Hooton Alex Valdez and Jeff Bridges and was devoted 91636 for use by the division of motor vehicles. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. Medium duty electric trucks have a GVWR of 10000 pounds to 26000 pounds.

DR 1316 - Colorado Source Capital Gain. Save time and file online. The table below outlines the tax credits for qualifying vehicles.

Colorado now offers a 2500 state income tax credit for eligible light-duty electric cars purchased or leased before January 1 2026. Drive Electric Colorado exists to provide you individual consumers with information about electric vehicles in Colorado. To receive this credit taxpayers must file a Colorado.

DR 0366 - Rural Frontier Health Care Preceptor Credit. If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit. DR 0375 - Credit for Employer Paid Leave of Absence for Live Organ Donation Affidavit.

The 2018 Colorado Electric Vehicle Plan In January of 2018 Colorado released its first electric vehicle plan9 The 2018 Colorado Electric Vehicle Plan was the result of Executive Order D 2017-015 which directed CEO and partner agencies to develop a plan for building out EV fast-charging corridor stations across the state to facilitate economic. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche. Hybrid electric vehicles and trucks Manufactured and converted electric and plug-in hybrid electric motor vehicles and trucks that are propelled to a significant extent by an electric motor that has a battery capacity of at least 4 kWh and is capable of being recharged from an external power source CNG LNG LPG or hydrogen vehicles.

Updated July 29 2021. We have established a goal to put 940000 electric vehicles on the road in Colorado by 2030 paving the way for a long-term goal of 100 light-duty vehicles passenger cars and. After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online.

If you lease an electric vehicle for two years beginning before the end of 2020 you can get a 2500 tax credit. November 17 2020 by electricridecolorado. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69.

You can get the credit by submitting the appropriate forms with your tax return. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a motor vehicle to use an alternative fuel or have replaced a.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. DR 0350 - First-Time Home Buyer Savings Account Interest Deduction. Please visit ColoradogovTax prior to completing this form to review our publications about these credits.

The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. Colorado EV Incentives for Leases. Some dealers offer this at point of sale.

For tax years January 1 2010 January 1. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. DR 0346 - Hunger Relief Food Contribution Credit.

DR 0347 - Child Care Expenses Tax Credit. Light duty electric trucks have a gross vehicle weight rating GVWR of less than 10000 lbs. 1500 between 2021 to 2026.

Electric Vehicle or Plug-in Hybrid Electric Vehicle Light Duty Passenger Vehicle 4000 2000 4000 7 and 7A. Ad Download Or Email CO DR 2175 More Fillable Forms Register and Subscribe Now. Tax credits are as follows for vehicles purchased between 2021 and 2026.

TaxColoradogov prior to completing this form to review. We last updated the. You do not need to login to Revenue Online to File a Return.

This bill was assigned to the Colorado House Energy and Environment Committee. There is a state tax credit that you can take advantage of in Colorado. Contact the Colorado Department of Revenue at 3032387378.

Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in. Calculate your tentative tax credit take the amount on line 14 multiplied by line 15. If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit.

Information about Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file. The credits decrease every few years from 2500 during January 2021 2023 to 2000 from 2023-2026. Colorado Electric Vehicle Tax Credit.

Electric Vehicle License Plate Bill. Examples of electric vehicles include.

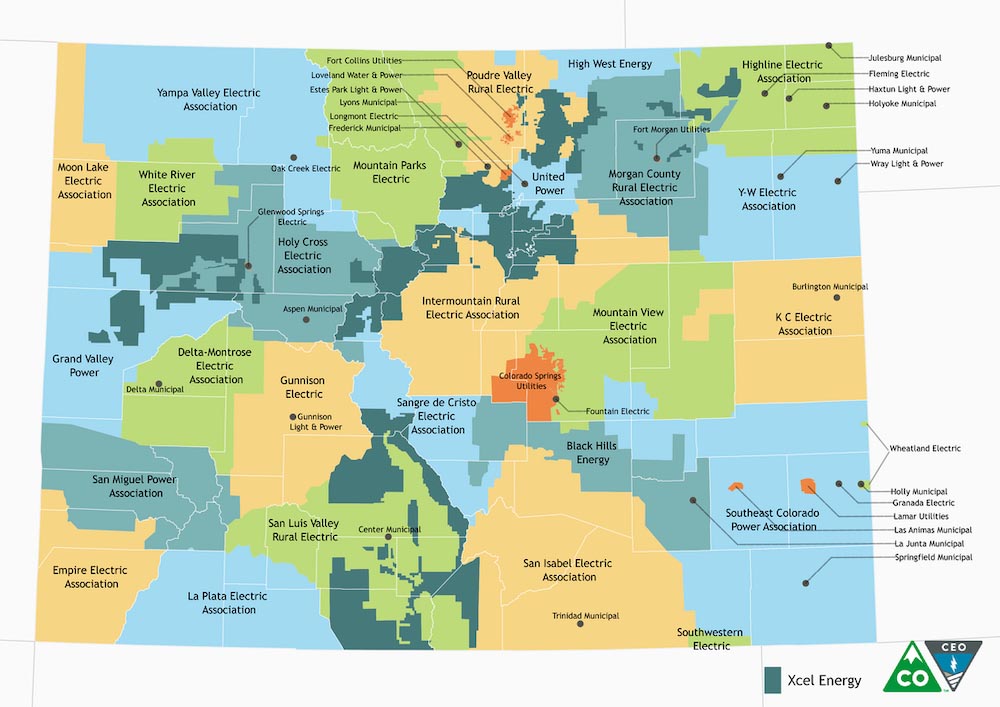

Utilities Rebates Incentives De Co Drive Electric Colorado

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Rebates And Tax Credits For Electric Vehicle Charging Stations

Electric Cars Cost Less Monthly Than Gas Cars In Most States Study

2022 Ev Tax Credits And Benefits In Colorado Peak Kia Littleton

A Fleet Manager S Guide Electric Vehicle Tax Credits

Electric Cars Cost Less Monthly Than Gas Cars In Most States Study

Rebates And Tax Credits For Electric Vehicle Charging Stations

Tax Credit For Electric Vehicle Chargers Enel X

Ev Charging Stations For Multifamily Buildings In Nyc

Is Buying A Used Electric Vehicle A Good Idea Autotrader

How To Claim An Electric Vehicle Tax Credit Enel X

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

City Of Pueblo Motor Vehicle Retailer S Statement Purchaser S Affidavit Bpi Dealer Supplies